INTEGRATED STRATEGIES

ACI Capital Group focuses on building value

as our core tenant and promise to investors.

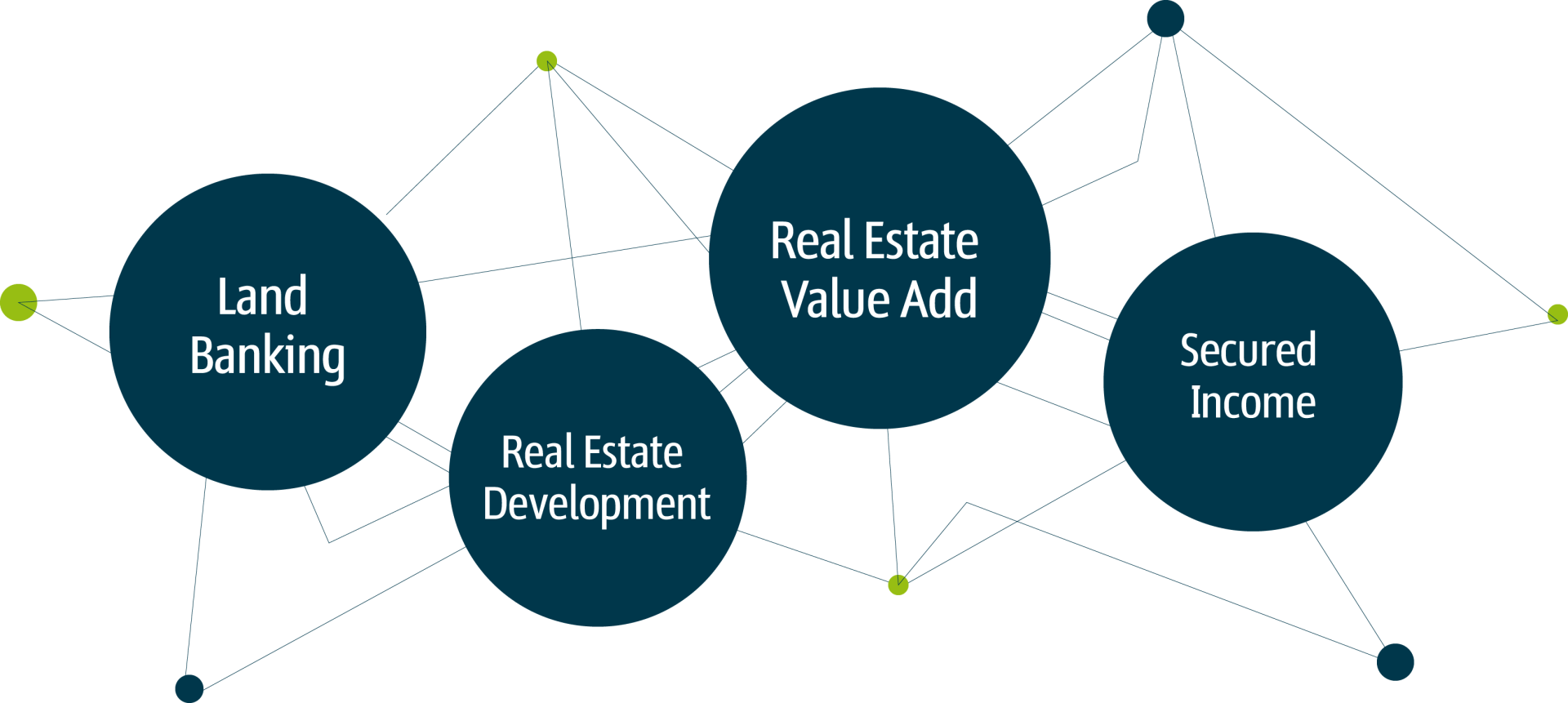

We believe that successful investments come exhaustive analysis and control of the risk variables. Our investment strategies cover a wide spectrum of real estate related opportunities around the entire real estate value chain. These four strategies are designed to provide Investors with a portfolio of risk-return options.

Moreover, our four investment strategies are focused along the real estate value chain due to the fact it allows us to control the product of each strategy.

Our land banking approach provides us with land for the development for our real estate rental (value add) and real estate development strategies (opportunistic) therefore In the practice of aggregating parcels of land our objective is the development for our value add and opportunistic funds or the future sale.

Our research team analyses macro-economic and real estate cycles with our unique municipality-based approach. We combine this with fundamental sector and market analysis to find investment opportunities in under-valued, emerging or recovering real estate markets. This allows us to find markets where real estate demand exceeds supply and where there is hidden value in income producing assets.

Our Competitive Advantage Arises From Analytics Models

That Allow Us To Predict and Optimize Investment Outcomes

ACI’s Research Division use the power of data to inform our investment and development strategies and unlock the value of our Real Estate.

Our operational focus and data-driven strategies are the pillars of our success.